Our Global Head of Youth Trends and Insight, Sam Clough, was invited for a second year running to contribute her expert opinion in the January edition of Toy World Magazine in the lead up to Toy Fair season. In her 2026 piece, Sam dives into her latest research into fandom lifecycle and how franchise connections evolve, which is shared below. You can check out the full edition of Toy World Magazine here and learn more about Toy World by heading to their excellent website here.

As we enter another Toy Fair season, reflecting on the successes and challenges of 2025, and preparing for a year of new launches, licenses, and innovation, many of the same strategic challenges are resurfacing with renewed intensity.

The rise of fandoms as a way for brands to tap into the deep and passionate relationships kids and teens form with these can’t be ignored. Youth audiences derive social and emotional benefits from taking a brand/IP relationship into a bona fide fandom. But kids grow up, and sometimes these fandoms wax and wane. For toy companies, it’s essential to be able to navigate this emotional and behavioural ebb and flow.

In our latest study at SuperAwesome, we set out to understand the fandom lifecycle – not just how young people connect with their favourite franchises, but how those connections change over time. We delved into why some fandoms unlock lifelong loyalty while others fade, then unexpectedly return, and what became clear is that the traditional notion of fandom as an upward engagement curve is no longer accurate. Instead, fandoms can behave as a cycle, meaning that Gen Alpha and Gen Z audiences discover a world, immerse themselves in it, step away as their interests evolve… and then, under the right conditions, come back again.

Toys Are Where Fandoms Start and Where Churn First Appears

Toys sit at the heart of this pattern. They’re one of the earliest ways children engage with a fandom, with our research showing an average discovery age of just 3.5 years for toys and collectables before gaming, streaming, or content creators begin to play a role. They’re where the concept of fandoms begin, where identity first takes shape, and characters become real. For younger children, especially, physical ownership is one of the purest expressions of love for a brand.

But as they grow, their worlds expand. Peer influence increases, interests shift, and brands that felt like everything at age five suddenly feel very uncool at nine. 38% of young people drop out of a fandom at some stage, with churn peaking between seven and nine. It might not be because of the IP or the toy, it’s just simple development. One respondent in our study put it plainly: ‘“I think it was probably like six or seven probably. It was Thomas the Train… But then…, as I got more into YouTube, I didn’t really play with my trains that much…I just kind of lost interest”, boy, 12. Kids aren’t rejecting the fandom itself but growing beyond it, at least for now.

The Re-Entry Window: When and Why Fans Return to Toy Brands

What matters for toy brands is that most departures are what we call “good exits”: the child hasn’t turned against the brand; they’ve simply moved forward. And this matters because good exits can become returns. When they re-enter fandoms later, they do it with nostalgia, agency, and renewed enthusiasm.

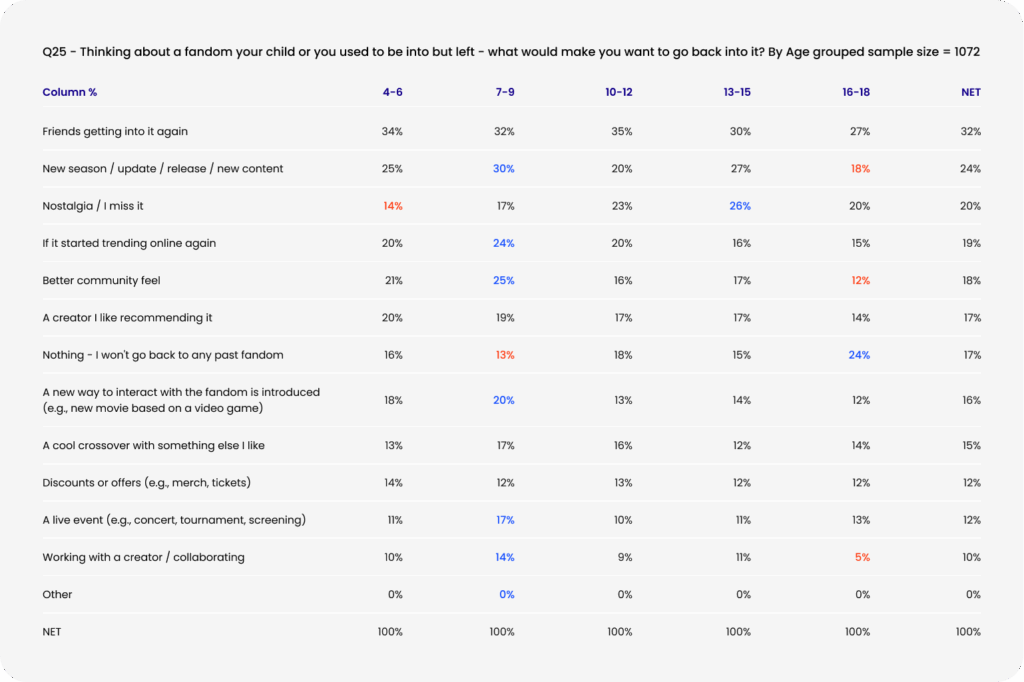

Crucially, these re-entries aren’t accidents. Something pulls them back in. Our data shows that new content or a major update was the most common catalyst for re-engagement (UK 24%, US 41%), followed by friends returning to the fandom (UK 32%, US 36%), crossovers with another interest (28%), and finding a new way to interact with the universe – be it a game, movie, or event (27%). Nostalgia itself drives re-entry for around 1 in 5 kids and teens in the UK and 1 in 4 in the US, but it isn’t self-sustaining. Think of it as the spark rather than the fuel that drives the fandom – something else has to be waiting on the other side.

With the rise of kidults, we can expect to see more tweens and teens tapping back into their favourite fandoms. This presents a meaningful opportunity for toy brands. If many fandom exits are pauses rather than endings, then toy brands should plan beyond discovery and engagement, but also for the comeback. People are still treating product cycles as linear – from launch, through to the peak, and then the tail-off. But for youth audiences, the curve loops. A brand may rise, fall away, and then rise again when a child’s interest is piqued, when a peer group revives desire, or when new content breathes life into the franchise. A strategic approach to re-entry can significantly extend the value of a brand or IP.

The commercial case is strong too. In the past three months, more than half of young fans made purchases to support a fandom, and nearly a third spent over £75. Collectables and merch are badges of belonging, and for many kids and teens, “I have it” means “I’m part of it.” The right toy line can revitalise a franchise just as powerfully as a new content drop – and when tied to storytelling or crossover moments, it’s rocket fuel for returning fans.

What This Means for Toy Companies

With this in mind, 2026 should be the year the toy industry begins planning how fans join and rejoin a franchise. This means thinking more deliberately about age-stage transitions: not fighting to hold them for one more year at the point of churn, but preparing to win them back five years down the road. Brands must know the moment a toy range risks being aged out, and how it could return with something new to offer. It means treating crossovers as engines for supercharging interest. It means recognising YouTube, the number one platform for fandom engagement, as a place where toy brands can spark re-entry through content, creator challenges, or playful storytelling. And it means treating nostalgia as a lever that works best when paired with freshness.

Ultimately, fandoms endure because they’re emotional. Toys endure because they’re physical. They’re something to hold, display, and return to. When the two intersect at the right moment in childhood, they build memories that last beyond a trend cycle. It’s true, the next generation moves on quickly. But they also come back regularly. This Toy Fair, companies have to go beyond capturing kids’ imagination and think about how to welcome them home when they return.

If the last decade taught us how to spark fandoms, the next will teach us how to sustain them. And the brands that understand the loop beyond the launch will be the ones building the franchises we’ll still be talking about at Toy Fair in the years to come.